The Best Remixes for Wedding DJs 2023

Wedding season has arrived! DJcity’s Remix Director Sir Marcus has put together a list of wedding-friendly tracks guaranteed to freshen up your DJ sets and...

Japanese electronics maker Pioneer announced on Tuesday that its selling its DJ business to a private equity firm KKR & Co LP for around 59 billion yen ($550 million).

While the majority of the company will be sold to US firm KKR, Pioneer will maintain a 14.95 percent voting stake in the DJ brand.

Last month, Reuters reported that Pioneer was in the final stages of selling its DJ business but the company issued a press release denying the news. Some believe the statement was ambiguous though: as it didn’t rule out the possibility of a future sale.

As previously reported, Pioneer is selling off its DJ business to focus on its automobile electronic business, which it believes has potential for expansion in emerging markets and increasingly connected cars.

During a media briefing held in Tokyo on Tuesday, Chief Executive and President Susumu Kotani explained the sale:

“We realized we wouldn’t be able to invest in the DJ business so it would be better to spin it off and grow it independently.”

He also said the DJ business was highly profitable and running an operating margin of nearly 20 percent on sales of 21.6 billion yen in the year ending March 31, writes Reuters.

Related: How to Mix Harmonically on Pioneer CDJs

Wedding season has arrived! DJcity’s Remix Director Sir Marcus has put together a list of wedding-friendly tracks guaranteed to freshen up your DJ sets and...

We just launched our biggest sale of the year! Get 90% off a DJcity membership and join for just $1 (regular price $10) for the first month when you check...

ATCG. Last Thursday, DJcity revealed its most downloaded tracks of 2023. Today, we dive deeper to uncover the most popular remixes, bootlegs, and edits of...

Here at DJcity, customer satisfaction is crucial, and therefore we always take input and feedback from our customers and DJ community very seriously. Due t...

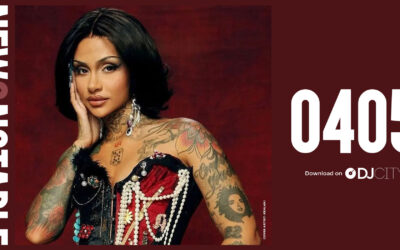

New tracks that DJs should know about.

At DJcity, we are always working to make sure that the way our record pool functions reflects the needs of our users. Therefore in our latest update, we sw...

Safety First!. (Source: Safety First!) Veteran Manchester-based DJ/producer Safety First! has released a DJcity exclusive remix of Salt-N-Pepa‘s hip-hop cl...

GRAYMATTER. Yesterday, DJcity revealed its most downloaded tracks of 2022. Today, we dive deeper to uncover the most popular remixes, bootlegs, and edits o...

Some fans were skeptical when they discovered that Skrillex and Diplo's debut Jack U album includes a song with Justin Bieber. "Where Are U Now" has...

New tracks that DJs should know about.